Max My Gift

Max My Gift

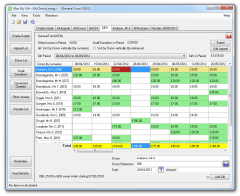

Gift Aid Management made easier.

Max My Gift

Max My Gift

Gift Aid Management made easier.

Max My Gift is a complete solution to managing donations and submitting reclaims to HMRC via the Government Charities Online Gateway. It has been recognised by HMRC and passed all the Gateway tests.

It also shares the submission engine used by G-Porter used by large charities to make regular high volume reclaims.

Max My Gift has at its heart a secure and robust SQL database to store the information in a single file. Using a single file makes it easy to back up and restore from a backup folder, memory stick or cloud storage.

I have been making Gift Aid reclaims since before the start of the current Gift Aid scheme and have around 15 years experience.

To help you decide whether it provides the Gift Aid reclaim solution for your charity, Max My Gift is freely available for download for a period of 60 days. The only restriction during this period is that electronic submissions via the Government Gateway are not allowed. At the end of the trial period you will also no longer be able to save changes to the data without purchasing a licence.

Max My Gift provides an audit trail for all donations and gifts made to the charity and can also be used to record gifts that cannot have the tax reclaimed on them. The reclaim will only include gifts from donors with a current Gift Aid declaration form in place. Max My Gift is an appeal based system so each donation is linked to a specific appeal. This makes it easier for the treasurer to allocate the reclaimed tax when it is received. For example a church may have a general fund, roof repair fund, christmas appeal, benevelent fund etc. and the amount reclaimed allocated appropriately.

To make it easier to get started, donor details can be imported using a comma separated file. This is useful if migrating from an existing system such as a set of spreadsheets.

Gifts are maintained in two periods in each tax year. The first period is from the tax year start 06/04/20YY to the charity accounting period year end (e.g. 30/09/20YY). The second period is the remaining term to the end of the tax year 05/04/20YY+1. To report over a single period, set the accounting date to 5th April. This arranges the data in manageable chunks.

Max My Gift models giving using numbered envelopes using unique references that are assigned to donors. Donor references cater for easy entry of regular donations and can also be used for sponsored events.

There is full support for the new small donations scheme where small amounts (less than £20) from unknown donors can be reclaimed up to £5000 in each tax year. Max My Gift keeps a record of entries and will only reclaim the maximum allowed.

Max My Gift also fully supports small donations made in community buildings up to the separate £5000 limit per building each year.

If your charity receives income from royalties, bank interest or other investments on which tax has been paid then Max My Gift records and reclaims the tax as part of the overall reclaim automatically via Charities Online.

At the end of the tax year a letter can be produced for each donor informing them of the gifts that they have donated over the tax year and the tax that is recovered. This is an important part of maintaining good relationships with donors. It lets the donor know that their support is recognised and helps them when filling in their self-assessment tax returns. If the letter is sent out before the reclaim is made it also gives an opportunity for a donor to stop a reclaim if their income tax circumstances have changed and they no longer pay income tax.

During the reclaim process Max My Gift can produce a letter to the treasurer summarising the amount reclaimed by appeal and the expected tax recovery. Once the money has been transferred from HMRC it can then produce a similar letter to the treasurer summarising the amount actually reclaimed and how it should be allocated to the appeals.

Max My Gift will cope with quite large volumes of data. The reclaim engine is shared with the high volume G-Porter tool used by large charities. Max My Gift loads all the data into memory to make it quick and easy to navigate over the data. Very large amounts of data may slow the initial loading of the data from the database but it has been tested using 40,000 donations in a year without any problem. Any charity with that many donations in a year is in an enviable position.

Max My Gift is available for £14.99.